Here's How To Pay Your Small Tax Liability To The Peer-To-Peer Loan

Like the platitude goes, "The main things sure in life are demise and assessments." Unfortunately, private ventures know this colloquialism great. |

Here's How To Pay Your Small Tax Liability To The Peer-To-Peer Loan |

With waning overall revenues and fixed loaning confinements, in any case, numerous entrepreneurs end up in a sticky situation when it comes time to pay the expense man. In spite of the fact that a business may have consistent deals and income or a huge number of dollars in stock, banks and conventional loaning organizations basically aren't giving out independent venture advances like they were in year's past, leaving entrepreneurs with few subsidizing choices to pay their assessment charge.

Gratefully, shared loaning, or social loaning, has understood this developing quandary. These cutting edge social loaning commercial centers have associated a large number of borrowers with singular speculators. Borrowers get low-premium, settled rate credits that can be paid off in two to five years, while speculators can profit by conventional returns in an economy with sinking security and investment funds rates.

In this manner, it's a win-win circumstance for both entrepreneurs needing quick subsidizing and financial specialists hoping to make a little benefit while helping other people.

From Desperation to Exultation: One Man's Venture into Peer-to-Peer Lending

John Mitchell is an Ohio-based entrepreneur who wound up in such a bind simply a year ago. As the proprietor of the main tool shop in a residential area, John's store prospered the initial couple of years it was open.

In the wake of getting his stock levels, valuing models, and administration without flaw, he chose to grow his business by opening a moment area in a neighboring town. John sunk the greater part of his benefits into opening his new store, which implied he was short on reserves come impose time. In any case, knowing the accomplishment of his business, he figured he would just get a little credit from the bank that housed his records and furnished him with the underlying advance he used to dispatch his business four years sooner.

Sadly, he saw direct the impact the retreat has had on loaning controls as the investor he's known for a considerable length of time denied his advance application. In the event that he couldn't get a credit there, where right?

On the very edge of sadness, John took to the Internet to inquire about advance alternatives. In the wake of burrowing through discussions and attempting a couple of various inquiries, he kept running crosswise over distributed loaning. In under seven days in the wake of experiencing the speedy and simple application process, he got an individual advance at a low rate for the sum he required. After seven days, John sent a check for everything to the IRS, and under eight months after the fact, he could pay off the credit with the benefits from his new store!

On the off chance that you are an entrepreneur who has ended up in a comparative situation, shared loaning can do likewise for you also, yet how does distributed loaning work?

How Peer-to-Peer Lending Works

An achievement item or administration develops each age, and in the mid 2000's, the rising leap forward was person to person communication. From aiding in the association of toppling political administrations to keeping in contact with loved ones, long range interpersonal communication has profoundly affected our day by day lives. Presently, it's changing the independent company financing scene too.

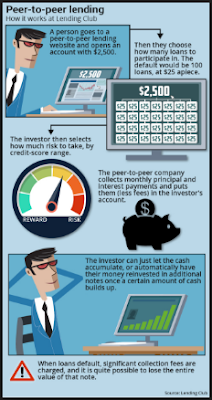

Shared loaning is an advanced long range informal communication answer for private ventures looking for a method for securing elective subsidizing. The objective of shared loaning destinations, for example, Prosper and Lending Club, is basically to interface singular financial specialists with those needing subsidizing, and these locales are turning into an undeniably valuable apparatus for entrepreneurs who can't secure subsidizing from customary moneylenders.

Instead of paying some dues just to be denied by a bank, private companies can get financing by means of distributed loaning in a matter of moments at all by following three basic advances:

Stage 1: Create a Profile and Loan Listing

There are a heap of distributed loaning systems to look over, so your initial step is to examine the best ones and make a profile and credit posting on the site you pick. The credit posting is basically a without cost promotion that shows the measure of cash you require and your coveted loan fee.

Stage 2: Let the Bidding Process Begin

After your posting goes live, financial specialists have the chance to start offering on your posting, furnishing you with the loan fee and advance sum they will offer you. A noteworthy preferred standpoint of this offering procedure is the way that it can increase as an ever increasing number of loan specialists start vieing for your business.

At the point when this happens, financing costs will start dropping, possibly enabling you to acquire a much lower loan fee than you anticipated. It's vital to note, be that as it may, that your FICO rating, salary, and obligation to-pay proportion assumes a part in the loaning choice process.

Stage 3: Funding and Paying Back the Loan

Another advantage of getting from shared moneylenders is that you can acknowledge a few offers to get your asked for credit sum. For example, on the off chance that you request $10,000 in your advance leaning to pay your business charges, you can gain the sum from gathering $2,000 from five distinct borrowers.

This makes it considerably less demanding for borrowers to get the cash they require. In any case, rather than making five separate installments, you would just make one installment, in light of the fact that the shared loaning site is in charge of scattering the cash to banks until the point when credits are reimbursed in full. They just charge a little expense for this administration.

With expanded loaning directions, banks are fixing their handbag strings like never before some time recently, making it significantly more troublesome for independent companies to get the subsidizing they have to extend their business or even pay their assessments. Gratefully, shared loaning has turned out to be a commendable rival in the independent company loaning commercial center. On the off chance that you are an entrepreneur and get yourself unfit to pay your duties as April approaches, or supported expenses so far as that is concerned, a shared advance is a perfect alternative.